Unlock Maximum Returns

with AI-Driven Automated Trading Solutions →

AI-powered trading technologies designed to exploit market inefficiencies with minimal correlation to overall market trends.

Advanced Trading Ecosystem

Cutting-edge technology for optimized trading.

Partnering with 120 trusted affiliates for success.

- Our Ecosystem

Vertus empowers your fund with AI-driven algorithms, harnessing vast data once accessible only to major financial institutions.

Portfolio Creation

Leveraging AI-driven strategies to build a diversified, market-neutral portfolio that maximizes returns and minimizes risk.

Data Harvesting

Collecting real-time data from over 150,000 trading systems across 30+ markets, enabling precise sentiment analysis and deep learning insights.

Scoring Engine

Evaluating trade performance using multi-dimensional metrics like Sharpe and Sortino ratios, ensuring optimal risk-adjusted returns and system calibration.

Risk Management

Monitoring each trade with real-time exposure and correlation analysis, ensuring resilience under varying leverage conditions and market risks.

Dynamic Rebalancing

AI-driven rebalancing and real-time reporting ensure full transparency, offering advanced monitoring and analysis for both retail and institutional clients.

Continuous Optimization

Monthly reviews, forward testing, and Monte Carlo analysis keep the portfolio agile, ensuring optimal performance by ranking and maintaining the top 100 subsystems.

Investing In Future Technologies

Leveraging cutting-edge innovations and AI-driven solutions to invest in future technologies, ensuring sustainable growth, market adaptability, and long-term success in an evolving financial landscape.

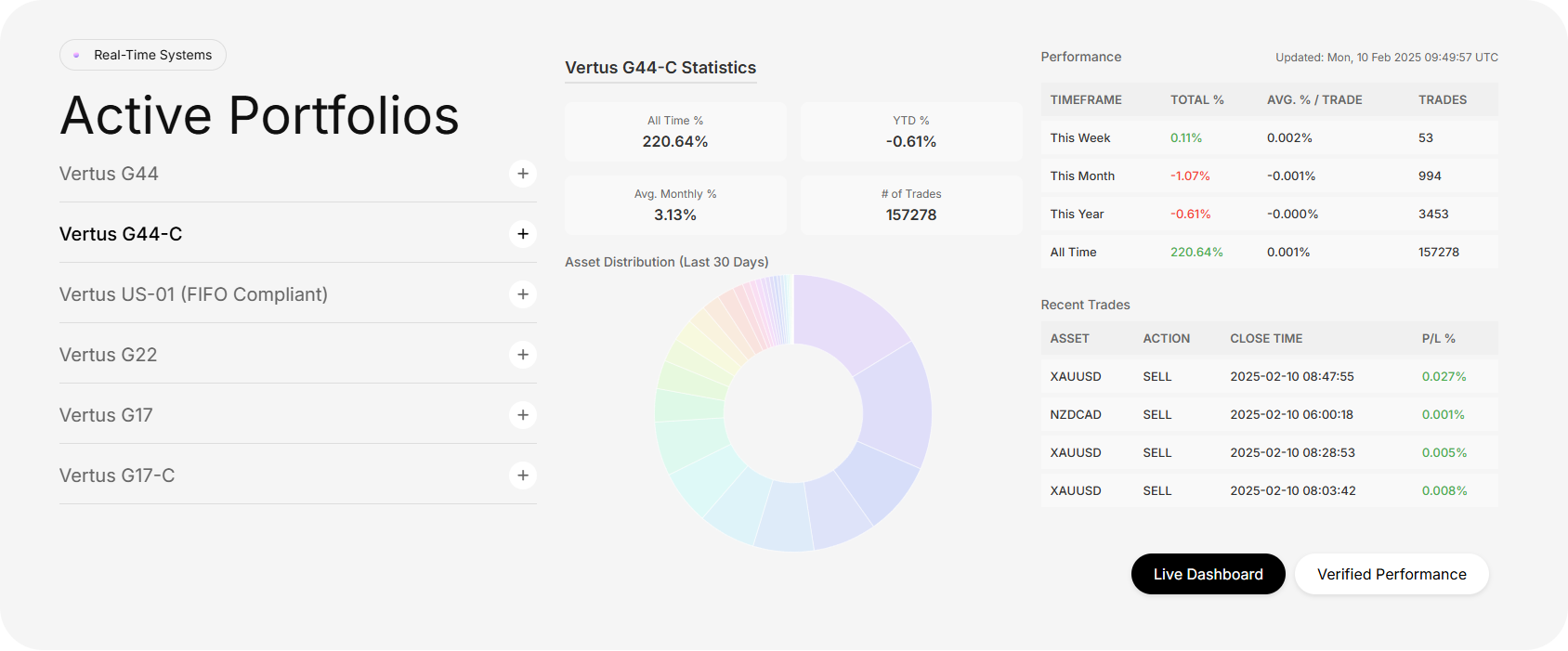

- Our Statistics

Imperium FX Pro is a quantitative AI-driven financial technology company providing ultra-diversified and dynamically evolving investment solutions for optimal market performance and long-term growth.

- Risk Management

Risk Management & Security

- We manage risk at the subsystem level, limiting drawdowns to between 0.1% and 5%. Our custom risk management system ensures subsystems stay within these set parameters.

- Our portfolios ensure strong risk mitigation through broad diversification across asset classes, trading strategies, time horizons, and market sessions, greatly reducing the fund’s risk of drawdowns.